Adding the CA prefix to your name will unlock infinite career options for you.

You could start a private practice, join a firm, do a partnership, and even pursue a corporate job.

Unsurprisingly, the latter is one of the most preferred options nowadays.

And If you do decide to go the corporate way, there are several job rules you can pursue, the majority of them are in the areas of Auditing, taxation, statutory, etc.

Now, the application process for these and more such job roles is dramatically different and personalized. But being a chartered accountant, there are some interview questions that you will continue to face regardless of your job domain or offer.

And so this is a quick guide to some of the most commonly asked questions to CAs in most job interviews:

Behavioural Questions

1. Tell me About yourself.

The question is usually asked when the interviewer hasn’t had the chance to scan through your resume. It’s mostly open-ended and your focus while answering it should be on highlighting the positive aspects of your professional life, such as your productive hobbies, your areas of interest, and a subtle hint at your past achievements and work experience.

A good way to make an impression is to present your own opinions on certain things about your career and why you are pursuing what you are doing right now.

The answer shouldn’t stretch more than a minute.

Here’s a sample answer.

“I come from [city] and have settled here now for my professional obligations. I pursued the CA program after my 12th which I completed from [school_name].

I did my articleship from [firm_name] where I was responsible for [work_responsibilities]. I have worked in statutory audits, internal audits, and tax audits and have covered the various aspects and operations right from Vouching to Finalization.

As a highly-driven individual, I often strive to take up opportunities that challenge me both physically and mentally.

As a result, I have also received great exposure to various clients across multiple industries.”

2. How do you think will you be able to add value to this organization?

Give examples from your previous job about your work ethic, your achievements, the clients you worked with, etc.

If you are pursuing any certifications or additional qualifications that relate to your role in the company, be sure to mention them as much as you can.

3. What are your strengths?

Always supplement the strengths you mention with real-life examples.

So for example, if you state time management as your strength, you’d follow it up with, “I tend to set personal deadlines for all my projects and I have been able to commit to ALL of them”

Some basic strengths that you could mention are:

- Team-management

- Analytical skills

- Attention to detail

- Fast-learner

- Multi-tasking (not-recommended)

- Empathetic (if you can provide a good example for it, this could be a great one)

4. What are your weaknesses?

Don’t ever try the typical approach such as, “I work too hard”, or, “I am too analytical”. This is one question that you can honestly answer albeit with some tact.

A potential answer to this can be,

“I often tend to self-criticize myself a lot. It’s something that stems from my childhood. But I am currently pursuing therapy for it and I am making a lot of progress in overcoming it”

5. What are some pros and cons of working in a team according to you?

Draw out logical pros and cons for the same but assume the stance that you can excel with or without a team.

An answer like this could work,

“Well, the obvious pros are that you get to share and amplify ideas, get feedback on your drawbacks, and get work done fast. The obvious cons are that there can arise a situation of ‘too many cooks'. Tasks are often delayed if a team is not properly organized or if team members are not answerable to each other.

In the past, I have got to work both as a team member and as an individual, and although my most productive work is when I am working alone.

Things tend to happen a lot more quickly when I am in a team.”

6. What according to you was the most difficult phase of your college life?

A very safe and bang-on answer could be,

“The most challenging phase of my college life was also one of the best ones. It was the final year because at the time I was bombarded with work and its stress. I was pursuing an articleship, I was managing my extracurricular, I had to do college project submissions, and was also preparing for my college exams.

And there was also the looming preparation for the CA finals. But that phase really activated my most productive self yet for even though there were all these challenges, I was able to traverse through them all and managed to become a stronger and more confident version of myself”

7. What prior work experience you have had?

That’s pretty much a no-brainer except for the fact that if you don’t have a lot of work experience, then it's best to mention your certifications or any other upskilling programs that you pursued.

Your priority here is to explain what you have done with the time that was supposed to be your work experience years.

If you do have work experience, try to mention all your responsibilities and achievements during your work.

8. Tell me about a difficult situation you faced in your previous company and how you solved it?

You can describe a specific situation from your articleship or internships or about a specific client.

Choose a situation that was not overly complicated and which you were able to solve rather flawlessly.

9. Where do you see yourself in 5 years?

Please for the love of god, do not say, “In your seat”. That’s an instant thumbs down.

Approach this question with a focus on skills and work domains.

Start by stating your aspirations about your career and the skills that you want to learn in the future,

If you do have managerial ambitions, then convey it to them in subtle words like,

“I see myself leading a team in the future and leading the auditing of a high-level client.”

10. List any 3 personal negative traits that you have, and what you are doing to improve them

You can afford to be honest here as long as you are not mentioning any negative traits that might directly impact your job profile.

For example,

“I don’t think I could count that many negative traits, but yes one negative trait about me that instantly comes to my mind is my inability to handle criticism from others. I often end up becoming too much upset even over slight criticism, but its something that I have been trying to cure with self-help books”

11. What are the conditions under which you do your best work? When it comes to working conditions, what do you find most challenging?

Again a straightforward answer could be,

“I do my best work in a thriving, encouraging, and positive work environment with an active competitive spirit. I can usually get along with my peers and acquaintances howsoever their behavior might be as I believe that I am excellent at dealing with people.

However, a toxic work environment where people are trying to drag each other down would be the biggest challenge for me."

12. How would you tackle such a challenge?

The follow up answer would be,

“In case I come across such a toxic work environment, my first plan of action would be to establish some serious boundaries so that other people don’t walk all over me.

Second, I would assume a formal stance while dealing in situations where people are intentionally being offensive.

My major objective would be to sustain my productivity, not let the toxicity derail my focus, and remain cordial and formal with the team to improve efficiency.

13. When comparing one company's offer to another, what factors will be important to you besides starting salary?

The most important aspect for me will always be personal growth and a sustainable learning curve. That being said, an equally important aspect is the work environment.

I think a company’s work culture and the opportunities it can provide to me are far greater reasons for me to choose it than the monetary compensation it can offer.

14. When comparing one company's offer to another, what factors will be important to you besides starting salary?

Being genuine yet diplomatic is the way to go here,

"The most important aspect for me will always be personal growth and a sustainable learning curve.

That being said, an equally important aspect is the work environment.

I think a company’s work culture and the opportunities it can provide to me are far greater reasons for me to choose it than the monetary compensation it can offer."

Technical Questions

1. What are the roles and responsibilities of a CA in an organization?

A CA as the official expert at accounting and auditing knowledge is responsible for key areas of financial reporting and accounts in an organization.

.jpg)

The chartered accountant's responsibility is to implement accounting systems and processes, prepare monthly financial reports, control the general ledger data, and ensure compliance with state revenue laws.

2. How do you calculate the total income of an assessee?

There are 5 heads of income that are generally considered while maintaining the total income of the assessee:

- Income from Salaries

- Income from House Property

- Profits from Business and Profession

- Income from Capital Gains

- Income from Other Sources

3. Is There A Criteria For Exemption From HRA?

HRA of an employee depends on the following criteria:

- Salary of the employee

- House Rent Allowance

- Rent paid by the employee

- The place where the house is taken on a rental basis.

4. Explain The Difference Between Short Term Capital Asset And Long Term Capital assets.

Short-term capital assets – Any asset owned by an individual (taxpayer) for less than 3 years since the date of transfer/ownership is referred to as a short-term capital asset. This duration should be less than 12 months in the case of shares.

Long-term capital assets – Any asset owned by an individual (taxpayer) for more than 3 years since the date of transfer to his/her name is treated as a long-term capital asset. This duration is taken as 12 months or more in the case of shares.

5. What are some allowances that are fully taxable?

Following are some compensation for employees that are completely taxable:

- Dearness Allowance

- City Compensatory Allowance

- Medical Allowance

- Lunch Allowance

- Servant Allowance

- Family Allowance

- Warder Allowance

- Overtime Allowance

- Family Allowance

6. What are The Golden Rules Of Accounting?

The golden rules of accounting help in documenting the financial transactions in ledgers. These golden rules are based on the type of account. Each transaction will have a debit and credit entry and belong to one of the following three types of accounts:

Real Account: Debit what comes in, Credit what goes out

Nominal Account: Debit all expenses and losses, credit all incomes and gains

Personal Account: Debit the giver, Credit the received

7. Explain What Is Bop in accounting?

A country's balance of payments (BoP) records all its economic transactions with the rest of the world over a given period of time, usually a year. In simple terms, it is a systematic accounting balance sheet of the country and includes both debit and credit transactions.

BoP accounting aims to determine the economy's strengths and weaknesses. You can determine the overall gains and losses from international trade by analyzing the BoP accounts of the previous year.

8. What Is The Incidence Of Tax?

The tax incidence measures how much tax is actually paid by whom. In this study, tax policies are analyzed in order to determine how price changes will affect consumers or producers, as a result of new tax policies.

- Market tax incidence refers to how taxes are distributed between buyers and sellers.

- It largely depends upon the price elasticity of demand and supply.

- In the case of elastic goods(which people purchase but are not out of necessity), the tax burden is faced by the suppliers.

- Similarly, in the case of inelastic goods(which people purchase out of necessity), the tax burden is faced by the consumers.

9. Explain what is Inflation, and how is it measured by the government bodies?

Inflation is the overall increase in prices of goods and services throughout the economy over time. It is measured by comparing the prices of goods and services currently with the past price records.

The Wholesale Price Index (WPI) and the Consumer Price Index (CPI) are used in India, to measure inflation (CPI).

- In India, the wholesale price index (WPI) is the main measure of inflation. The WPI measures the price of a representative basket of wholesale goods.

- CPI is a comprehensive measure used for the estimation of price changes in a basket of goods and services representative of consumption expenditure in an economy. The change in CPI gives a good indication of the overall inflation in the country.

10. Who is a resident or Ordinarily resident?

Residents and Ordinarily Residents are those who satisfy any one of the basic conditions and both of the following additional conditions -

Basic Conditions:

- In the relevant past year, he is in India for a period or periods amounting in all to at least 182 days.

- He is in India for 60 days or more during the relevant previous year and has also been in India for 365+ days during four previous years immediately preceding the relevant previous year.

Additional Conditions:

- He has been Resident in India for at least 2 out of 10 previous years immediately preceding the relevant previous year.

- He has been in India for 730 days or more during 7 previous years immediately preceding the relevant previous year.

11. What do you understand by Superannuation Fund? How is it taxed?

A superannuation fund is a form of employee welfare that is usually applied to very senior employees. The employee's contribution, the employer's contribution, and interest thereon are paid to the employee after the employee ceases to be an employee, and in case of death, to the employee's legal heirs.

Here’s how a superannuation fund is taxed:

- An employee’s contribution to the superannuation fund is eligible for a tax rebate under Section 80C.

- On the other hand, the employer’s contribution to the superannuation is completely exempt from taxes.

- Interest on the accumulated balance in the superannuation fund is exempt from tax.

- The amount paid to the employee in lieu of or in commutation of an annuity on his retirement on or after the specified age or on his becoming incapacitated prior to such retirement is exempt from tax.

- The amount paid by way of refund of contribution to the legal heirs on the death of the beneficiary is also exempt from tax.

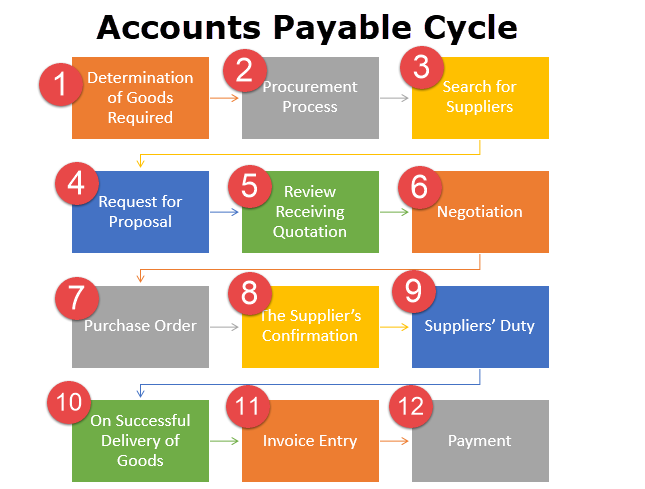

12. Explain the accounts payable cycle.

An Accounts Payable cycle also called 'Procure to Pay' or 'P2P', entails all activities related to placing orders, procuring goods for suppliers, and making final payments to suppliers.

13. What are Perpetual and Periodic Inventory systems?

Companies keep inventory on hand for production purposes or to sell on the market. It includes raw materials and finished goods. There are two types of inventory: periodic and perpetual.

The periodic inventory consists of physical counts made at various points in time, while the perpetual inventory uses point-of-sale and enterprise asset management systems to track inventory. Compared to the latter, the former is more cost-effective.

14. What are material facts in accounting?

Material facts in accounting are those facts that affect the financial statements to a great extent and thus need to be disclosed.

The material facts are the bills or other documents that form the basis of every account book. As a result, all the documents on which an accounting book is prepared are termed material facts.

15. What are accounting ethics that a CA should practice?

The conceptual framework establishes 5 principal ethics that an accounting professional should follow throughout his professional career. They are:

- Integrity.

- Objectivity.

- Professional Competence and Due Care.

- Confidentiality.

- Professional Behavior.

16. Define Assessment year and Previous Year.

Assessment year- It is a 12-month period that begins on 1st April and ends on 31st March. For example 1st April 2011 to 31st March 2012.

Previous Year- This is the year immediately preceding the assessment year. For example, income earned between 1st April 2010 and 31st March 2011 is assessed or charged to tax for A.Y. 2011-2012.

.jpg)