The Chartered Financial Analyst (CFA®) charter is awarded to those who have completed the CFA® Program and have acquired acceptable work experience.

In the CFA Program, the candidate is tested on investment tools, valuing assets, portfolio management, and wealth planning.

Furthermore, they are then qualified to work in senior and executive positions in investment management, risk management, asset management, and more.

A large part of your post-CFA job preparation would be to prepare for the interviews. Job interviews for designations like financial analysis, investment banking, or portfolio management are often intensive and consist of both behavioral and technical questions.

Behavioural Questions

1. Tell me About yourself.

The question is usually asked when the interviewer hasn’t had the chance to scan through your resume. It’s mostly open-ended and your focus while answering it should be on highlighting the positive aspects of your professional life, such as your productive hobbies, your areas of interest, and a subtle hint at your past achievements and work experience.

A good way to make an impression is to present your own opinions on certain things about your career and why you are pursuing what you are doing right now. The answer shouldn’t stretch more than a minute.

Here’s a sample answer.

“I come from [city] and have settled here now for my professional obligations. I pursued the CA program after my 12th which I completed from [school_name]. I did my articleship from [firm_name] where I was responsible for [work_responsibilities]. I have worked in statutory audits, internal audits, and tax audits and have covered the various aspects and operations right from Vouching to Finalization.

As a highly-driven individual, I often strive to take up opportunities that challenge me both physically and mentally. And as a result, I have also received great exposure to various clients across multiple industries.”

2. What are your strengths?

Always supplement the strengths you mention with real-life examples.

So for example, if you state time management as your strength, you’d follow it up with, “I tend to set personal deadlines for all my projects and I have been able to commit to ALL of them”

Some basic strengths that you could mention are:

- Team-management

- Analytical skills

- Attention to detail

- Fast-learner

- Multi-tasking (not-recommended)

- Empathetic (if you can provide a good example for it, this could be a great one)

3. What are your weaknesses?

Don’t ever try the typical approach such as, “I work too hard”, or, “I am too analytical”. This is one question that you can honestly answer albeit with some tact.

A potential answer to this can be,

“I often tend to self-criticize myself a lot. It’s something that stems from my childhood. But I am currently pursuing therapy for it and I am making a lot of progress in overcoming it”

4. What are some pros and cons of working in a team according to you?

Draw out logical pros and cons for the same but assume the stance that you can excel with or without a team.

An answer like this could work,

“Well, the obvious pros are that you get to share and amplify ideas, you get feedback on your drawbacks and you get work done fast. The obvious cons are that there can arise a situation of ‘too many cooks’. Tasks are often delayed if a team is not properly organized or if team members are not answerable to each other.

In the past, I have got to work both as a team member and as an individual, and although my most productive work is when I am working alone.

Things tend to happen a lot more quickly when I am in a team.”

5. What according to you was the most difficult phase of your college life?

A very safe and bang-on answer could be,

“The most challenging phase of my college life was also one of the best ones. It was the final year because at the time I was bombarded with work and its stress. I was pursuing an articleship, I was managing my extracurricular, I had to do college project submissions, and was also preparing for my college exams.

And there was also the looming preparation for the CA finals. But that phase really activated my most productive self yet for even though there were all these challenges, I was able to traverse through them all and managed to become a stronger and more confident version of myself”

6. What prior work experience you have had?

That’s pretty much a no-brainer except for the fact that if you don’t have a lot of work experience, then it's best to mention your certifications or any other upskilling programs that you pursued.

Your priority here is to explain what you have done with the time that was supposed to be your work experience years. If you do have work experience, try to mention all your responsibilities and achievements during your work.

7. Walk us through an investment declaration that you will show to your senior management.

Try to avoid talking about software when you are answering this interview question for a financial analyst. Focus on elaborating your thinking process here.

You can mention that you first try to understand the intent of an investment decision. Then you would collate income statements, cash flow statements, and balance sheets. After collecting financial information, you would ask senior management if there is any change required from business partners. In the end, you may also want to suggest other investment options.

Technical Questions

1. Describe ‘financial modeling’.

Quantitative analysis of financial data is widely used for asset pricing as well as general corporate finance. To predict the future impact of today's decisions, a company's expenses and earnings are taken into account (often in spreadsheets).

The financial model also turns out to be a very impactful tool for the following tasks:

- Estimate the valuation of any business

- Compare Competition

- Strategic planning

- Testing different scenarios

- Budget planning and allocation

- Measure the impacts of any changes in economic policies

You can also share your experience through different financial models, including discounted cash flow models (DCF), initial public offerings (IPOs), leveraged buyout models, consolidation models, etc., since financial modeling is one of the most important primary skills.

2. Is it possible for a company to have a positive cash flow but still be in serious financial trouble?

To answer this Financial Analyst interview question you can say:

Yes. There are two examples –

A company that is selling off inventory but delaying payables will show positive cash flow for a while even though it is in trouble

A company has strong revenues for the period, but future forecasts show that revenues will decline

When you define such situations, it proves that you are not looking at the cash flow statements; instead, you care about where the cash is coming from or going to and mark all the points highlighting how the company is making or losing money.

3. When evaluating a company's stock, what is the best evaluation metric?

The main intention of this question is to check your critical thinking abilities and logical skills. Additionally, this question allows you to demonstrate your ability to identify potential pros and cons of investment options.

Technical analysts generally use the following types of charts to check the stock price, which is the basis for picking the right one:

- Line charts (helps in tracking daily movements)

- Bar charts (helps in tracking periodic highs and lows of stock price)

- Point chart (helps in determining stock momentums)

4. What is working capital, and which are the different types of working capital?

As a general rule, working capital can be defined as current assets minus current liabilities.

Its primary purpose is to determine the amount of money you have readily available to meet all of your current expenses.

Financial analysts play a major role in information mediation on capital markets, so understanding working capital needs is very important. It is also important for an analyst to stay on top of forecasting the actual working capital requirements, especially when the company is constantly expanding or growing.

Additionally, you can highlight some previous incidents when your existing company felt the need for additional working capital, and you can even explain how you managed to do so.

You can also demonstrate your skills by demonstrating how you and your team used working capital data to meet current and future needs.

5. Explain quarterly forecasting and expense models.

The analysis of expenses and revenue which is predicted to be produced or incurred in the future is called quarterly forecasting.

In this case, a complete financial model along with an income statement is useful. Making a realistic model, however, is challenging, which is where a financial analyst comes in.

An expense model, on the other hand, tells what expense categories are allowed on a particular type of work order, which forms the foundation of building a budget. Additionally, to make this model functional, an expense projection model is created, which helps with identifying variable and fixed costs which forms a basis for accurately forecasting the company’s expected profit or loss.

6. What do you know about valuation techniques?

In general, three types of valuation techniques are used for calculating the value of a business or stock:

DCF analysis – helps in forecasting future cash flows

Comparable company analysis – evaluates the current value of a business based on its P/E ratio, EBITDA, and other metrics.

Precedent transactions – identify the transactional value of a company by comparing it with similar businesses that have recently been sold.

7. What do you mean by ratio analysis?

Using financial statements, financial analysts use ratio analysis to gain a deeper understanding of a company's overall equity analysis.

The analysis of different ratios helps stakeholders measure a company's profitability, liquidity, operational efficiency, and solvency. By combining these ratios with other essential financial metrics, you can gain a deeper understanding of the company's financial health.

Analyzing ratios helps in:

- Examining the current performance of your company with past performance

- Avoiding potential financial risks and problems

- Comparing your organization with other

- Making stronger and data-driven decisions

8. As a financial analyst which factors do you constantly analyze?

As part of your pre-interview prep, you must keep information like this in handy. This you can do by making notes of methods and procedures analysts ought to use to evaluate or analyze financial data.

Some of these are:

- Risk exposure and how the business will affect the current working capital?

- How to streamline finance requirements and make business processes effective?

- Identifying the right opportunities based on capital and/or revenue.

- How will financial decisions affect key value drivers?

- Which product/ customer segment/ target audience largely affects profit margins and what will be the future impact on margins affected by today’s choices, financial strategies, and decisions?

- Which decisions can affect our stock price?

9. What will you use to gauge the company’s liquidity – cash flow or income?

A firm's liquidity is determined by its ability to pay off its current debt with its current assets. Liquidity can be measured in the following ways:

- Calculate the current ratio of the company (Current Assets/Current Liabilities)

- Calculate the quick ratio (Current Assets-Inventory/Current Liabilities)

- Find the Net Working Capital of the company (Current Assets – Current Liabilities)

If you must choose between cash flow and income, it is a better idea to gauge the company's liquidity based on cash flow, as earnings are more reliable.

10. What is important to consider when deciding on capital investment?

Before making a definite decision on capital investment, you should consider the following:

- Managerial outlook

- Defending against the competitor's strategy

- Technological advancements create opportunities

- Budget for cash flow

- Fiscal Incentives

- Market Forecast

- Other non-economic factors

11. What is EBIDTA? And why is it important?

By asking this question, the recruiter wants to see what in-depth industry knowledge you have about EBITDA. You can frame your answer using the following:

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It is a measure of a company’s overall financial performance. It can be misleading because it does not include the cost of capital investments like property, equity, plant, and equipment.

EBIDTA can be calculated by the below-given formula:

EBITDA=Net Income+Interest+Taxes+D+A

where:

D=Depreciation

A=Amortization

12. What are the types of financial analysis? Explain at least three.

This is a basic finance question for those intermediate in the field.

Liquidity Analysis is one of the many types. It utilizes the company’s balance sheet to gauge whether it can fulfill short-term obligations. This is done through the use of different methods including:

- Current Ratio ( Current Ratio = Current Assets/ Current Liabilities)

- Acid Test

- Net Working Capital

Leverage Analysis is used for evaluating a business’s performance. This is commonly done through finding the debt/equity ratio, DuPont analysis model, etc. Vertical Analysis refers to checking the different components of a company’s income statement. Each of these components is then divided by the business’s revenue. Using the result, an enterprise should compare with other businesses in its related industry.

13. Should you increase the consumer base by 1% or price by 1%?

You should tactfully respond to this finance interview question. Do mention that the decision primarily depends on demand and supply. As it is important to retain and increase customers, keeping the price the same will generate more profit. By increasing the price, a business may lose customers.

14. What are the components of the DuPont model and how are they calculated?

Asset turnover ratio, financial leverage, and net profit margin are the main aspects of the DuPont model. With these, a company’s return on equity (ROE) is evaluated.

Net Profit Margin is calculated with the following steps:

- Profit Margin = Net Income /Revenue

The formula for calculating the Asset Turnover Ratio is:

- Asset Turnover Ratio = Net Sales (or Revenue) / Average Assets

Financial Leverage is calculated by:

- Financial leverage = Average Assets / Average Equity

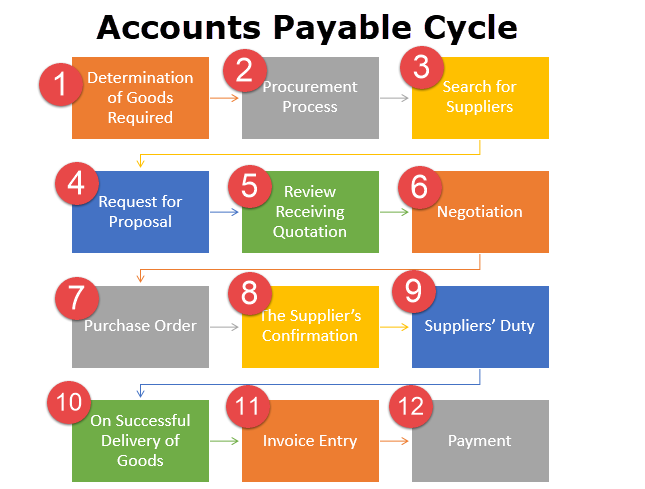

.jpg)

.jpg)